1. Introduction

According to Ajanthan and Kumara (2017), the most liquid asset of the firm is cash, which is used to pay the company’s bills on time and is also used as a measure for paying commitments, but retaining idle cash is of no advantage to the organization. As a result, businesses strive to keep cash reserves high enough to produce positive cash flows.

Optimal level of cash is the primary element for a company to exist and develop for a long period. However, determining the suitable level for maintaining an optimal cash level is difficult because it not only helps the firm provide liquidity but also covers a substantial component of the current asset portion of the balance sheet. Furthermore, businesses are enticed to have cash on hand to ensure smooth operations, meet short-term obligations, and select a viable investment option. During a cash shortage, cash acts as a buffer, preventing a high cost of opportunity.

Maintaining large amounts of cash, according to Jensen (1986), causes an agency problem because managers tend to exploit it for personal gain. Managers in organizations with weak corporate governance systems try to have more cash on hand, which leads to rash over investment, such as costly acquisitions, which has severe consequences for the company’s shareholders (Jensen, 1986). Cash is a two-edged sword in that keeping idle cash reserves reduces the likelihood of financial trouble while increasing the manager’s influence over the company’s assets, which is the core assumption of Jensen’s free cash flow theory (1986).

Whereas, in the domain of corporate governance, only a few studies were conducted at first, but in recent years, scholars in Asia have given this issue substantial thought. Since its inception in March 2002, corporate governance in Pakistan has attracted the attention of researchers. Following the modifications in 2017, the researchers have paid more attention to the corporate governance areas and cash holding separately.

According to the researcher’s knowledge, the majority of study in Pakistan has focused on cash holding or corporate governance mechanisms individually. This research will be conducted with the goal of examining two important elements of corporate governance that have an impact on a company’s cash holdings. As a result, this study will add to the literature by examining the relationship between two fundamental aspects of corporate governance, namely board structure and board committees, and the cash holdings of companies. As a result, the study used a sample size of 168 non-financial firms for a 5-year period, from 2016 to 2020.

2. Literature Review

This section of the investigation involves reviewing literature to aid in the establishment of the study’s main hypothesis. As a result, this portion is divided into two parts. It will begin by reviewing key theories related to currency holdings. Second, the study will examine various empirical and conceptual findings about the relationship between corporate governance procedures and cash holdings.

2.1. Cash Holding Theories

Companies have a variety of reasons for keeping cash on hand. First, corporations often require cash for initiatives with a positive net present value, which they can obtain both from their cash reserves and through capital markets. Many theories exist that explain the motivations for keeping large amounts of cash in various ways, but Keynes’s (1936) “The General Theory of Employment, Interest, and Money, ” published in 1936, is the most important research.

According to the literature, pecking order theory and trade-off theory play a key role in business decisions on cash holdings. According to the trade-off approach, anytime a corporation decides to maintain an optimal cash level, it first weighs the benefits and costs of keeping cash on hand. The importance of keeping cash is that the corporation does not need to raise funding for a project from other sources, which has a high transaction cost. However, the question arises as to whether or not the manager is enhancing shareholder wealth. What is the most significant expense of cash hoarding? The cost of keeping cash is also related to a lower return because it pays off less than other equally hazardous assets. As a result, if the manager’s decisions benefit the shareholders, the only cost is a decreased return, which is costly and creates an agency problem. As a result, cash hoarding gives management more authority, and they begin to act against the interests of shareholders, bringing more and more of the company’s assets under their control (Jensen, 1986).

According to pecking order theory, knowledge asymmetry plays a key role in the issuance of new equity since it makes it more expensive. As a result, businesses aim to fund their needs primarily through internal sources of funds, with external sources used only if internal sources are insufficient. Empirically, organizations with good corporate governance systems are more likely to do a cost-benefit analysis before making investment decisions, and these judgments are based on data. There will be less information asymmetry and the firm will hold more cash if they have a strong corporate governance structure, but they must keep in mind that if the benefits of investing through internal sources outweigh the benefits of investing through external sources, they must make a trade-off.

Furthermore, the free cash flow theory suggests that in businesses, managers want to have more cash on hand to gain adequate influence and power over corporate assets to make better judgments. As a result, they can simply opt for non-profitable projects because they are not obligated to raise funds from outside sources, which has a direct influence on the shareholders’ wealth. Furthermore, stock agency difficulties have been linked by Jensen (1986) to the existence of a large amount of free cash flows at the discretion of the company’s management. As a result of an excess of free cash flows and a lack of effective monitoring, the issue of agency arises between shareholders and managers. As a result, organizations with a lot of free cash flow have a hard time keeping track of their stock agency costs.

2.2. Board Structure Relationship with Cash Holdings

Because board structure plays such a significant role in the organization, academics are particularly concerned about board structure characteristics and their impact on cash holdings. The size of the board, its independence, the presence of executive directors, the leadership structure (CEO duality), and the frequency of board meetings are all factors to consider.

2.2.1. Leadership Structure

A company’s leadership structure is also known as CEO duality, which refers to when one individual serves as both chairman and CEO of the company at the same time. According to leadership literature, CEO duality aids in the creation of a sense of command and leadership unity. In contrast, agency literature claims that CEO duality causes the problem of the agency since it undermines the board’s ability to be successfully overseen and entrench the CEO. Conflicts in the literature have arisen as a result of such divergent views on leadership structure. Those who believe in organizational theories and research leadership structures support CEO duality, whereas followers of agency theory try to prevent it to restrict the CEO’s potential entrenchment. Furthermore, Fama and Jensen (1983) suggested that boards of directors are used as a monitoring device in businesses, but that combining both positions and handing them over to one person will negatively affect board members’ performance, thus absolving them of fiduciary responsibilities. Jensen (1993) agreed, arguing that the board’s independence is unlikely to encourage this dualism. According to agency theory, duality leads to asymmetric knowledge, which raises the cost of external capital. As a result, it is assumed that when duality exists, cash holding will be higher.

2.2.2. Board Size

According to Jensen (1993), the size of the board is the most contentious issue since it influences the monitoring function of the board. As a result, an effective board is critical to the company’s success. Because the board of directors is such a large body for corporate decision-making, it has the task of offering wise direction to ensure the firm’s growth and increase investors’ returns. Furthermore, the company’s board of directors is solely responsible for disciplining and overseeing senior management. A large board of directors can effectively supervise the activities of the firm’s management and provide superior expertise. According to Lipton and Lorsch (1992), huge boards face both the problem of social loafing and the problem of a free ride. As a result of the increased coordination among the members, it can be shown that monitoring quality is considerably better in small boards.

2.2.3. Board Independence

In the case of board independence, there should be an agreement between practice and academia on their relationship since board independence improves the monitoring and transparency functions of the company. As a result, Fama and Jensen (1983) concluded that an independent board structure aids in aligning the interests of managers and shareholders, and as a result, they have a greater advantage in attracting more shareholder interest. The purpose of appointing independent directors is to promote the interests of firm shareholders. Independent directors join the organization without financial incentives, and the reason they do so is to advance their own reputation and keep it for a longer period of time. As a result, it is believed that they will objectively supervise the corporate executives.

2.2.4. Executive Directors

According to Ullah and Kamal (2017), empirical research literature has indicated that adding executive directors to a firm’s board of directors either establishes or improves the board’s performance. CEOs prefer the existence of executive directors because it increases the entrenchment and welfare of the CEOs, according to agency theory. Because the executive directors of the company are reliant on the CEO for continued employment, private benefits, and income, most studies show that executive directors are unable to take positions on the board if the CEO is challenged. According to Jensen and Meckling (1976), agency theory argues that entrenched managers strive to keep a large amount of cash for themselves rather than paying a dividend to shareholders, resulting in the issue of free cash flow agency. By examining such reasons, it is possible to conclude that executive management supports cash stockpiling.

2.2.5. Board Meeting Frequency

According to Zhang et al. (2007), if board members meet regularly, the board’s effectiveness will grow. They went on to say that it would have an impact on the quality of internal control in businesses. Such regular board meetings also aid in the formulation of board strategy (Vafeas, 1999) and drive board members to work in the best interests of shareholders (Lipton & Lorsch, 1992). Aside from that, other scholars have suggested that if board members meet frequently, it would not improve the board’s control and effectiveness because they will be spending the majority of their time meeting rather than working in the best interests of shareholders. They also result in travel expenses fees as well as allowances for attending the conference, resulting in a cost to the company (Vafeas, 1999).

2.3. Board Committees Impact on Cash Holdings

According to empirical studies, board committees have an essential role in corporate performance and cash holding, therefore this study examined the audit and remuneration committees to see how they relate to cash holding.

2.3.1. Auditors

The job of auditors must be highlighted since they aid in the security of accounting records and the protection of the organization from owner theft. However, if the auditor is unable to detect the fraud, the owners will be granted the right to manipulate financial records to conceal their self-dealings. Even though East Asian auditors are fully delivering quality assurance services and reducing the agency’s difficulty, it remains a point of contention.

Furthermore, DeFond and Jiambalvo (1993) argued that East Asian external auditors play a larger role in governance than external auditors in the United Kingdom and the United States because their legal systems and traditional corporate control systems are less effective at protecting investors’ interests. Despite the existence of the Big Five accounting firms as well as multinational businesses, the market for external auditors remains active when compared to the market for independent directors or takeovers. DeFond et al. (2000) researched eight East Asian nations and found that big five auditors are preferred by companies with high ownership concentration and agency problems.

2.3.2. Audit Committee Size

Auditing and reporting, among other critical aspects of corporate governance, play a significant role. As a result, Saad (2010) argued that the board should establish proper audit committees to assist in the monitoring of accounts, audits and reporting of the company’s financial statements. By allowing shareholders to control and supervise the firm’s resources, an effective reporting and auditing system also aids in resolving agency concerns. Auditing and reporting serve as the most important function in an organization’s corporate governance since they provide better oversight of managers, allowing shareholders to properly control their company’s management. Furthermore, if properly audited and reported, strong governance could aid in the reduction of agency conflicts.

The audit committee is expected to become a source for lowering agency costs and assisting in the resolution of the problem that will occur as a result of asymmetric knowledge. According to Benjamin and Karrahemi (2013), the audit committee should be a certain size, and it should include executive and independent directors who meet on a regular basis and have unique competence in finance and audit. Furthermore, the audit committee is responsible for overseeing the financial reporting procedures of publicly traded companies, as their presence ensures fewer irregularities in financial reporting and a smaller margin for mistakes in financial statements.

2.3.3. Audit Committee Meetings

Because observing the diligence of audit is difficult and cannot be immediately viewed, audit committees are expected to complete their tasks and duties in a suitable manner to maintain the integrity of their monitoring function. As a result, the research employed the frequency of audit committee meetings as a proxy for measuring the audit committee’s conscientiousness. The frequency of audit committee meetings indicates the number of meetings held by the audit committee during the year, which demonstrates their activity and seriousness. The Sarbanes-Oxley Act of 2002 in the United States makes non-regulatory recommendations that the audit committee holds a certain number of meetings each year (Benjamin & Karrahemi, 2013).

2.3.4. Remuneration Committee

Although the company must have a remuneration committee made up of executive directors, this does not mean that the executive directors will be allowed to choose their compensation plan. As a result, firms must include details of their compensation committee in their annual reports (Braiotta & Sommer, 1987). Furthermore, the committee’s primary responsibility is to recommend a proper remuneration framework for the firm’s board of directors, as well as appropriate remuneration packages for senior executives and individual directors. The role of the remuneration committee is similar to that of the audit committee in that it improves the boards’ accountability and supervision of management on behalf of the shareholders.

Therefore, following the above arguments, no clear idea about the relationship can be observed between the remuneration committee and cash holdings but it can be observed that there is some kind of association between the remuneration committee and cash holdings of the firm.

2.4. Hypothesis

Based on the above literature, the following are the major hypothesis of the study:

H1: Leadership structure has a positive association with cash holding.

H2: Board size has a positive association with cash holding.

H3: Executive directors have a positive association with cash holding.

H4: Board independence has a positive association with cash holding.

H5: Board meeting frequency has a positive association with cash holding.

H6: Auditors have a positive association with cash holding.

H7: Audit committee size has a positive association with cash holding.

H8: Audit committee meetings has a positive association with cash holding.

H9: Remuneration committee has a positive association with cash holding.

3. Methodology

To investigate the relationship between corporate governance mechanisms and cash holdings, the researchers used a sample size calculator to select 204 non-financial firms from the Pakistan Stock Exchange, with a confidence level of 95% and a confidence interval of 5% for a total population of 436 non-financial firms. The study sample size was reduced to 168 non-financial enterprises after the outliers were removed. Furthermore, according to the research of Kusnadi (2011), Boubaker et al. (2015), and Kuan et al. (2012) the financial sector was neglected because of its distinct capital and profit structure, as well as its unique restrictions surrounding liquidity and cash holdings. The study will last for five years; thus the results will be available from 2016 to 2020. The reason for choosing these years is that the occurrence of phenomena can be observed more clearly in these years because data related to the study variables is now completely available in annual reports, and companies have also changed their structures as a result of corporate governance amendments. Data on corporate governance mechanisms is manually taken from annual reports available at the Pakistan Stock Exchange, while data on finance for control variables is gathered from the companies’ unconsolidated financial statements.

The study used VIF analysis to analyze the problem of multicollinearity while deflating the control variables by total assets of the firms to overcome the problem of heteroscedasticity. Furthermore, summary statistics were used to assess the mean, lowest, and maximum values in the study. The study also used a correlation matrix to look for collinearity between variables. Finally, the study used the Hausman test to confirm the study’s model.

Furthermore, the major variables that are used as dependent, independent, and control variables are discussed below in the table along with supporting literature, names, symbols, and measures (Table 1).

Table 1: Variable and Their MeasuresThe study selected panel data to investigate the influence of time and cross-section over numerous years for the same companies since it provides a much better grasp of the phenomenon. This model is also used by Marimuthu, Khan and Bangash (2021) in their studies. The study used classic panel data models, such as fixed effect and GLS random effect regression, to tackle the problem of multicollinearity and heterogeneity. The current study has used the models of Kusnadi (2011), Lee and Lee (2009), Gill and Biger (2013), and Ajanthan and Kumara (2017) to find the association between these variables in the context of Pakistan. Below is the regression model of the study, which is going to be used for regression. In the model, symbol i represents cross section whereas, t represents time series.

Cashi,t = α + β1LSi,t+ β2BSi,t + β3BIi,t+ β4EXDi,t + β5BMFi,t + β6ADi,t+ β7ACSi,t + β8ACMEETi,t + β9RCi,t+ β10NWCi,t + β11LEVi,t + β12SIZEi,t + εi,t

A regression technique is used to examine the relationship between corporate governance qualities and cash holdings. The reason for employing panel data in this study is that it allows for control for unobserved heterogeneity, which makes the outcomes more efficient. The study has covered fixed effect and random effect models in this section to perform the analysis since they are the most commonly used models for panel data analysis (Gujarati & Porter, 2003).

4. Results and Discussion

This section shows the important part of the study which includes summary statistics and other regression results along with their interpretation and discussion.

4.1. Summary Statistics

Table 2 shows the number of observations, mean, standard deviation, maximum, and minimum values of the variables in the sequence as summary statistics. The goal of calculating a summary statistic is to convey all of the data’s information while also removing any outliers. When the summary statistic of the data was first calculated, certain variables had values of more than 99 percent, while others had values of less than 1%. Data from several companies related to leverage that were greater than 1 and less than –1 were removed since leverage cannot be greater than 1 and less than –1. To stay solvent, the companies leverage is required to be less than 1 and this is supported by the theories.

Table 2: Summary StatisticsTable 2 shows that for the sample size of 168 companies, there were a total of 600 observations. In contrast, the cash has a mean of 0.154, indicating that enterprises in Pakistan maintain 15.4 percent of cash as reserves. The leadership structure has a mean of 0.055, indicating that on average, there is still a 5% CEO duality in Pakistani non-financial enterprises. Furthermore, the mean value of board size is 7.97, implying that the average boardroom in Pakistan has 7.97 directors, whilst the minimum and maximum values show that the minimum number of directors on a board is 5 and the maximum number is 20 for non-financial enterprises. Furthermore, the value of board independence is 0.192, which implies that on average, 19.2 percent of independent directors are included in the boardroom in Pakistan, which is relatively low when compared to developed countries such as the United States, which has 53.90 percent, independent directors. The average number of executive directors on the board is 24.1 percent, according to the executive director mean. While the mean value of board meeting frequency shows that Pakistani non-financial enterprises hold an average of 5 meetings each year.

The mean score of 0.446 for auditors indicates that Big 5 audit companies in Pakistan perform 44.6 percent of audits. While the average size of an audit committee board is 3.33 members, the mean for audit committee size shows that there are 3.33 members on average. Furthermore, the mean figure for audit committee size indicates that the audit committee holds 4.21 meetings every year. Furthermore, the remuneration committee has a mean of 0.99, indicating that 99 percent of enterprises in Pakistan have remuneration committees for the sample size chosen. The mean values of control variables show that net working capital is -0.084, leverage is 0.64, and firm size is 15.9, indicating that Pakistani non-financial enterprises are on average large.

4.2. Correlation Matrix

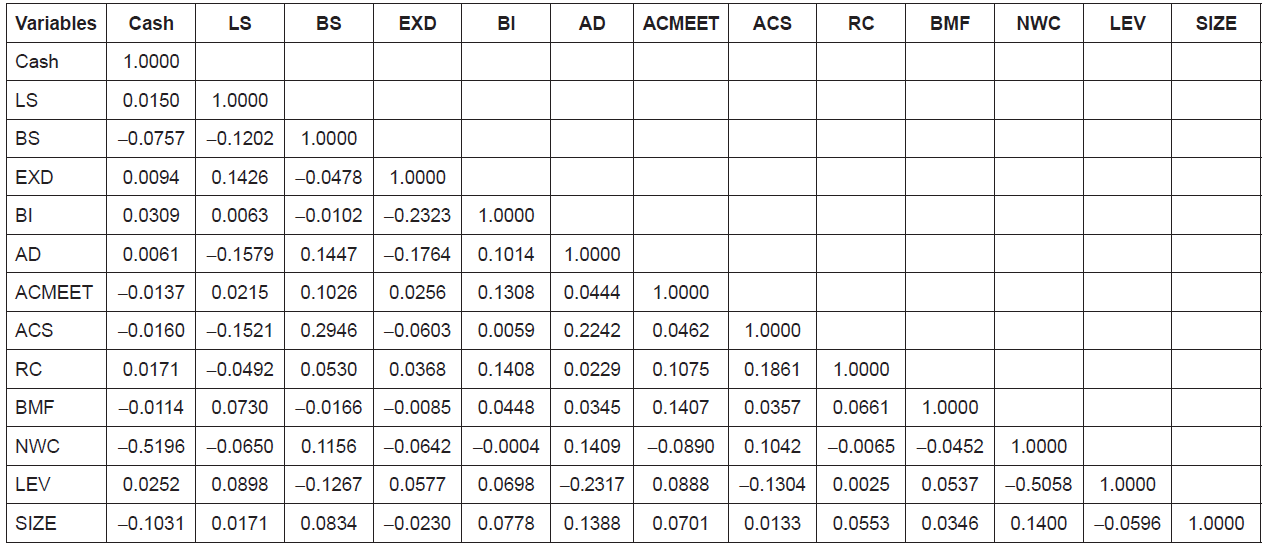

Before running the regressions, the researchers ran a Pearson correlation test on the variables under consideration to ensure that there was no collinearity between them. According to Gujarati and Porter (2003), there is no multicollinearity among variables if the variables have a value less than 0.6. As a result of their values being less than 0.6, it may be stated that there is no multicollinearity among variables (Table 3).

Table 3: Pearson Correlation Matrix 4.3. Variance Inflation Factor (VIF)

4.3. Variance Inflation Factor (VIF)

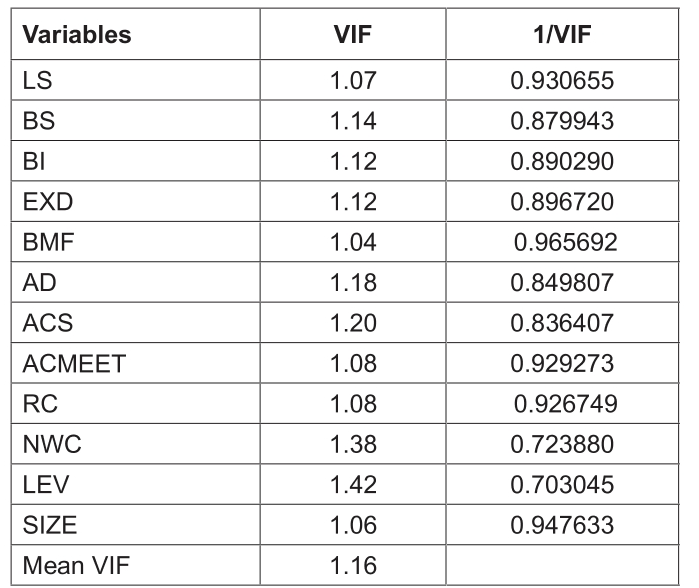

The VIF analysis is also used to check for multicollinearity between variables (Table 4). If the mean of the VIF is more than 5 or 10, it indicates that the data has a multicollinearity problem. The mean value of 1.16 for VIF is shown in table IV, indicating that there is no multicollinearity related to values between 5 and 10 (Gujarati & Porter, 2003).

Table 4: Variance Inflation Factor 4.4. Regression Results

4.4. Regression Results

Because panel data is the nature of the data, panel data regression models were employed to examine the impact of the independent variable on the dependent variable. To eliminate the problem of heterogeneity and multicollinearity, the current study examined both random and fixed effect models. The study used the Hausman test, which was created by Hausman, to pick the best model between the two. Greene (2008) outlined the major hypothesis of the Hausman test. According to Greene (2008), the null hypothesis will be accepted if the P-value of the Hausman test is greater than 1%, 5%, or 10% significance threshold, indicating that the random effect model is a good fit for an estimate. If the P-value is less than 1%, 5%, or 10%, the null hypothesis of Hausman will be rejected, and an alternate will be accepted, i.e. the fixed effect model will be the best estimator.

The results of the Hausman test are listed below, which show that it has a P-value of less than 1%, 5%, and 10%, indicating that the null hypothesis is rejected and the alternate hypothesis is accepted. As a result, the study’s explanation will be based on the fixed effect model.

4.4.1. Hausman Test Results for Cash Holding

Test: Ho: difference in coefficients not systematic

chi2 (12) = (b - B)′[(Vb - VB)(-1)](b - B) = 46.52

Prob > chi2 = 0.0000

4.4.2. Fixed Effects (within) Regression Results

Table 5 shows the results for fixed effect (inside) regressions for the dependent variable, i.e. cash holdings, after model validation from the above Hausman test findings (Table 5).

Table 5: Fixed-Effects (within) Regression Results*,**, *** refers to significance level at 10%, 5% and 1%.

4.4.3. Testing Hypothesis

The findings of the fixed effect (inside) regression model for cash holdings are shown in Table 6. According to the regression results, there were 168 groups in the study with a total of 600 observations. Furthermore, the R2 value indicates that the research independent variables (corporate governance process) had a 42.68 percent impact on the firm’s cash holdings. The study’s model is significant because the P-value is less than 0.05, i.e. it has a value of 0.0000. Aside from that, studying the board structure’s coefficient values for independent variables has yielded conflicting findings. When a negative coefficient value for leadership structure is identified with a P-value less than 0.05, it indicates that leadership structure has a substantial negative link with the firm’s performance. The coefficient of board size, on the other hand, has a negative value but a P-value greater than 0.05, indicating that board size has an insignificant negative impact on the firms’ cash holdings. Executive directors have a negative coefficient value with a P-value larger than 0.05, indicating that they have a negative inconsequential impact on the firm’s cash holdings. Board meeting frequency is another variable that has demonstrated a significant impact due to a lower P-value with cash holding, however, its coefficient value shows a negative relationship.

Table 6: Testing of the Study HypothesisFurthermore, when looking at the coefficient values of board committees’ linked factors, there are mixed results between independent variables and cash holding. The auditors’ coefficient indicated a positive relationship, although its P-value was more than 0.05, indicating that auditors have a minor positive relationship with cash holdings. Furthermore, the size of the audit committee has a positive coefficient value, but the P-value is bigger than 0.05, indicating that the relationship between audit committee meetings and cash holdings is inconsequential. Furthermore, audit committee meetings have shown a negative coefficient value with a P-value greater than 0.05, indicating that it has a negligible negative impact on cash holdings. While the remuneration committee has a negative coefficient and a P-value larger than 0.05, this indicates that the remuneration committee has a negative inconsequential impact on the cash holdings of the enterprises.

Similarly, control variable outcomes have had inconsistent results. Because networking capital has a negative coefficient value but a P-value of less than 0.05, it has a negative significant impact on a firm’s cash holdings. Leverage, on the other hand, has a negative coefficient value but a P-value of less than 0.05, indicating that leverage has a significant negative impact on cash holdings. Business size is the only control variable with a positive coefficient value but a P-value greater than 0.05, indicating that firm size has a positive but negligible impact on cash holdings.

4.5. Discussion

After examining the coefficients and P-values of independent variables, it can be concluded that only three of the study’s hypotheses are valid, while the others are rejected due to their negative associations and higher P-values. The auditors, audit committee size, and board independence are three ideas that have been regarded as having a positive impact on cash holdings. Acceptance of the auditors and audit committee size hypothesis (H6, H7) indicates that the big five auditors and audit committee size have no direct impact on the firm’s cash holdings. However, because of its favorable association with cash holding, it will give rise to the firm’s cash holding if it adequately monitors fraud and director activities. These results of the study are in correspondence with the findings of Simon et al. (1992) and Defond and Jiambalvo (1993). Whereas, the board independence hypothesis (H4) has depicted positive insignificant results which is corresponding to the study of Ajanthan and Kumara (2017), Anderson et al. (2004), Harford et al. (2008), and Kuan et al. (2012) Jaturat, Dampitakse and Kuntonbutr (2021). They also found insignificant results and therefore argued that board independence has no significant repercussions on the firms’ cash holdings but if it is considered, it helps in reducing the agency problem of the firm and the Sarbanes-Oxley Act also promotes it.

The leadership structure hypothesis (H1) is rejected since it has a negative impact on the firm’s cash holdings, this conclusion is consistent with the findings of Fama and Jensen (1983), Jensen (1993), Vance (1983), and Daily and Dalton (1997) Tran and Nguyen (2021)., as well as the agency literature. Such leadership structure results reveal that CEO duality causes an issue of the agency since it hinders the board’s ability to supervise properly and entrench the CEO. Furthermore, the rejection of another hypothesis of board meeting frequency (H5) demonstrates that frequent meetings have a detrimental impact on the firm’s cash holdings. Because paying allowances and providing expenditures to the firm’s management for meetings increases the firm’s cost. These results of the study are in line with the findings of Vafeas (1999), Jensen (1993), Lipton and Lorsch (1992), and Ullah and Kamal (2017).

The remaining hypothesis of the study is likewise rejected since it has a negligible negative relationship with the firm’s cash holdings. The results of the board size hypothesis (H2) are negative and negligible, which corresponds to the findings of Boubaker et al. (2015), who also found a negative and insignificant relationship between these two variables. They argued that board size has no bearing on a firm’s cash holdings because the relationship is negligible, but if the negative association is taken into account, larger boards face the problem of social loafing and free-riding (Lipton & Lorsch, 1992). Furthermore, the executive directors’ hypothesis (H3) is dismissed because it has an insignificant negative impact on cash holding. Furthermore, the executive directors’ hypothesis (H3) is dismissed because it has a negligible negative impact on cash holding. These findings are consistent with Jensen and Meckling (1976), Ullah and Kamal (2017), and Fama and Jensen (1983), who suggested that increasing the number of executive directors in a corporation reduces the amount of capital available for ownership. Furthermore, the audit committee meeting and the remuneration committee both produced negative insignificant findings, indicating that they have no impact on the firm’s cash holdings.

If the negative relationship of audit committee meetings is taken into account, it means that audit committee meetings will limit firms’ managers’ attitude to free cash flows, resulting in less cash holding, as the agency theory suggests (Menon & Williams, 1994). The negative relationship between compensation committee and cash holding indicates that while the inclusion of a remuneration committee will improve corporate governance, it will also reduce the amount of cash held by the business due to board accountability and monitoring. The findings are consistent with Ajanthan and Kumara (2017), Ongore and K’Oboyo (2011), and Saad (2010)

Furthermore, the control variables’ results were mixed because net working capital had a negative and significant relationship with corporate cash holdings, which is consistent with Alam et al.’s (2011) findings and is also supported by the free cash flow theory. After all, it is used as a substitute for cash in terms of liquidity. Leverage has also had a negative and considerable impact on the firm’s cash holdings, which is consistent with Deloof (2003) and Faulkender and Wang (2006). They had argued that leverage can decline corporate cash holding. They stated that leverage can cause a decrease in a company’s cash holdings. While the results for business size showed a positive and negligible relationship with cash holding, these findings are consistent with Ferreira and Vilela (2004), Pinkowitz and Williamson (2001), and Bates et al. (2009), and the trade-off theory. According to them, size is a counter-proxy for asymmetric knowledge, and large corporations choose to store less cash.

5. Conclusion and Limitations

The primary goal of this research is to investigate the relationship between corporate governance tools, such as board structure and board committee, and the cash holdings of a company. The latest research is in accordance with the increasing literature on cash keeping. The findings in this study differed from those in the previous section. Previously, researchers studied various corporate governance indicators separately, but the current study combined all of them and found that board structure variables such as board size, executive directors, and board independence have no significant relationship with cash holding. The only variable that reveals a link in the firm’s leadership structure and board meeting frequency. While board committee characteristics such as auditors, audit committee size, audit committee meetings, and compensation committee have demonstrated no link to the firm’s cash holdings. The study also generated nine primary hypotheses based on the literature, but only three of them have been accepted, while the others have been rejected. The study used a sample size of 168 non-financial enterprises registered on the Pakistan Stock Exchange from 2016 to 2020 to explore these hypotheses.

According to the findings of the study, the leadership structure serves as a monitoring mechanism, but combining both posts and handing them over to one person will have a negative impact on the board members’ ability to discharge their fiduciary responsibilities. Furthermore, CEO duality will create an agency problem because it would undermine the board’s ability to effectively monitor the CEO while simultaneously entrenching the CEO. While board size and independence are useful indicators to compare with cash holding, executive directors, auditors, audit committee, audit committee meetings, and compensation committee are not because they have no significant impact on the firm’s cash holding.

Similarly, literature on such factors has failed to find any direct link between such characteristics and the firm’s cash holdings. While numerous board meetings have a substantial negative impact, the reason is that managers lose a lot of time and resources conducting meetings, thus stronger CEOs of the company avoid frequent board meetings.

The study’s major limitation is that it only examined non financial enterprises listed on the KSE, excluding financial organizations out due to their capital structure. The study had a small sample size of 204 enterprises, which was later reduced to 168 firms from all sectors after the outliers were removed. Furthermore, organizations with negative cash holdings and those that do not disclose corporate governance data were excluded from the analysis. Furthermore, some of the firm’s annual reports do not contain data that can be retrieved, thus these are also ignored.

The current study focuses on the relationship between corporate boards and committees and cash holdings by using only 168 non-financial enterprises as a sample size, but it could be expanded by using larger sample size and including all non-financial firms. Furthermore, because these attributes may differ from industry to industry, an industry effect might be included in the model. There are also some other significant variables to examine, such as audit committee directors and remuneration committee directors and compensation, which will have an impact on the firm’s cash holdings.

참고문헌

- Ajanthan, A., & Kumara, K. U. (2017). Corporate governance and cash holdings: Empirical evidence from an emerging country, Sri Lanka. International Journal of Accounting and Financial Reporting, 7(2), 112-128. https://doi.org/10.5296/ijafr.v7i2.12137

- Alam, H. M., Ali, L., Rehman, C. A., & Akram, M. (2011). Impact of working capital management on profitability and market valuation of Pakistani firms. European Journal of Economics, Finance & Administrative Sciences, 32, 48-54.

- Anderson, R. C., Mansi, S. A., & Reeb, D. M. (2004). Board characteristics, accounting report integrity, and the cost of debt. Journal of Accounting and Economics, 37(3), 315-342. https://doi.org/10.1016/j.jacceco.2004.01.004

- Bates, T. W., Kahle, K. M., & Stulz, R. M. (2009). Why do US firms hold so much more cash than they used to? The Journal of Finance, 64(5), 1985-2021. https://doi.org/10.1111/j.1540-6261.2009.01492.x

- Benjamin, S. J., & Karrahemi, K. E. (2013). A test of audit committee characteristics and free cash flows. Corporate Ownership & Control, 10(2), 611-626. https://doi.org/10.26569471863-x https://doi.org/10.26569471863-x

- Boubaker, S., Derouiche, I., & Nguyen, D. K. (2015). Does the board of directors affect cash holdings? A study of French listed firms. Journal of Management & Governance, 19(2), 341-370. https://doi.org/10.1007/s10997-013-9261-x

- Braiotta, L., & Sommer, A. A. (1987). The essential guide to effective corporate board committees. Upper Saddle River, NJ: Prentice-Hall.

- Defond, M. L., & Jiambalvo, J. (1993). Factors related to auditor-client disagreements over income-increasing accounting methods. Contemporary Accounting Research, 9(2), 415-431. https://doi.org/10.1111/j.1911-3846.1993.tb00889.x

- DeFond, M. L., Francis, J. R., & Wong, T. J. (2000). Auditor industry specialization and market segmentation: Evidence from Hong Kong. Auditing: A Journal of Practice & Theory, 19(1), 49-66. https://doi.org/10.2308/aud.2000.19.1.49

- Deloof, M. (2003). Does working capital management affect the profitability of Belgian firms? Journal of Business Finance & Accounting, 30(3-4), 573-588. https://doi.org/10.1111/1468-5957.00008

- Fama, E. F., & Jensen, M. C. (1983). Agency problems and residual claims. The Journal of Law and Economics, 26(2), 327-349. https://www.jstor.org/stable/725105 https://doi.org/10.1086/467038

- Faulkender, M., & Wang, R. (2006). Corporate financial policy and the value of cash. The Journal of Finance, 61(4), 1957-1990. https://doi.org/10.1111/j.1540-6261.2006.00894.x

- Ferreira, M. A., & Vilela, A. S. (2004). Why do firms hold cash? Evidence from EMU countries. European Financial Management, 10(2), 295-319. https://doi.org/10.1111/j.1354-7798.2004.00251.x

- Gill, A. S., & Biger, N. (2013). The impact of corporate governance on working capital management efficiency of American manufacturing firms. Managerial Finance, 39(2), 116-132. https://doi.org/10.1108/03074351311293981

- Greene, W. H. 2008. Econometric analysis (6th ed.) Upper Saddle River, NJ: Prentice-Hall.

- Gujarati, D. N., & Porter, D. C. (2003). Basic econometrics (ed.). New York: McGraw-HiII.

- Harford, J., Mansi, S. A., & Maxwell, W. F. (2008). Corporate governance and firm cash holdings in the US. Journal of Financial Economics, 87(3), 535-555. https://doi.org/10.1016/j.jfineco.2007.04.002

- Jaturat, M., Dampitakse, K., & Kuntonbutr, C. (2021). The Effect of Corporate Governance on the Board of Directors' Characteristics and Sustainability Disclosure: An Empirical Study from Thailand. The Journal of Asian Finance, Economics and Business, 8(12), 191-201. https://doi.org/10.13106/jafeb.2021.vol8.no12.0191

- Jensen, M. C. (1986). Agency cost of free cash flow, corporate finance, and takeovers. The American Economic Review, 76(2), 323-329. https://www.jstor.org/stable/1818789

- Jensen, M. C. (1993). The modern industrial revolution, exit, and the failure of internal control systems. The Journal of Finance, 48(3), 831-880. https://doi.org/10.1111/j.1540-6261.1993.tb04022.x

- Jensen, M., & Meckling, W. (1976). Theory of the firm: Management behavior, agency costs, and capital structure. Journal of Financial Economics, 3(4), 305-60. https://doi.org/10.1016/0304-405X(76)90026-X

- Keynes, J. M. (1936). The general theory of employment, interest, and money. London: Harcourt Brace.

- Kuan, T. H., Li, C. S., & Liu, C. C. (2012). Corporate governance and cash holdings: A quantile regression approach. International Review of Economics & Finance, 24, 303-314. https://doi.org/10.1016/j.iref.2012.04.006

- Kusnadi, Y. (2011). Do corporate governance mechanisms matter for cash holdings and firm value? Pacific-Basin Finance Journal, 19(5), 554-570. https://doi.org/10.1016/j.pacfin.2011.04.002

- Lee, K. W., & Lee, C. F. (2009). Cash holdings, corporate governance structure, and firm valuation. Review of Pacific Basin Financial Markets and Policies, 12(03), 475-508. https://doi.org/10.1142/S021909150900171X

- Lipton, M., & Lorsch, J. W. (1992). A modest proposal for improved corporate governance. The Business Lawyer, 48(1), 59-77.

- Marimuthu, M., Khan, H., & Bangash, R. (2021). Fiscal Causal Hypotheses and Panel Cointegration Analysis for Sustainable Economic Growth in ASEAN. The Journal of Asian Finance, Economics, and Business, 8(2), 99-109. https://doi.org/10.13106/jafeb.2021.vol8.no2.0099

- Menon, K., & Williams, J. D. (1994). The use of audit committees for monitoring. Journal of Accounting and Public Policy, 13(2), 121-139. https://doi.org/10.1016/0278-4254(94)90016-7

- Ongore, V., & K'Oboyo, P. (2011). Effects of selected corporate governance characteristics on firm performance: Empirical Evidence from Kenya. International Journal of Economics and Finance, 1, 99-122.

- Pinkowitz, L., Stulz, R., & Williamson, R. (2006). Does the contribution of corporate cash holdings and dividends to firm value depend on governance? A cross-country analysis. The Jounal of Finance, 61(6), 2725-2751. https://doi.org/10.1111/j.1540-6261.2006.01003.x

- Saad, N. M. (2010). Corporate governance compliance and the effects to capital structure in Malaysia. International Journal of Economics and Finance, 2(1), 105-114. https://doi.org/10.5539/ijef.v2n1p105

- Tran, N. H., & Nguyen, T. T. H. (2021). Factors Impacting on Social and Corporate Governance and Corporate Financial Performance: Evidence from Listed Vietnamese Enterprises. The Journal of Asian Finance, Economics and Business, 8(6), 41-49. https://doi.org/10.13106/jafeb.2021.vol8.no6.0041

- Ullah, S., & Kamal, Y. (2017). Board characteristics, political connections, and corporate cash holdings: The role of firm size and political regime. Business & Economic Review, 9(1), 157-179. https://doi.org/10.22547/BER/9.1.9

- Vafeas, N. (1999). Board meeting frequency and firm performance. Journal of Financial Economics, 53(1), 113-142. https://doi.org/10.1016/S0304-405X(99)00018-5

- Vance, S. C. (1983). Corporate leadership: Boards, directors, and strategy. New York: McGraw-Hill Companies.

- Zhang, Y., Zhou, J., & Zhou, N. (2007). Audit committee quality, auditor independence, and internal control weaknesses. Journal of Accounting and Public Policy, 2(3), 3. https://doi.org/10.1016/j.jaccpubpol.2007.03.001