1. Introduction

This research uncovers the role of inventory volatility in firm investment decisions, which can deteriorate the investment decisions as a close attachment with inventory efficiency. The improper handling of inventory can impact investment decisions, specifically investment for procurement of new machinery which can be pronounced as capital investment. It is more voidable as additional funds stuck into inventory may ultimately distress the funds flow in capital investment. More specifically, corporate managers decide about the procurement of new machinery in accordance with their production capacity. Due to voluminous production orders, the firms always require more property, plant, equipment, and even land while engaging in more production processes. If they face enormous variation in their inventory level, corporate managers cannot define their machinery demand precisely. In accordance with these notions, it is necessary to empirically check the possible variation in capital investment due to inventory volatility.

Moreover, it’s narrated to exemplify that volatility in different operations discourages the corporate managers from making any investment decision due to an increment in beta investment. The corporate managers are more concerned with investing behavior of the firm for fulfilling the possible demand options. But they cannot measure the demand and production to some extent because they do not consider volatility while investing in fixed assets and inventory management processes. Inventory volatility surges corporate managers’ biases. Thus, it is obligatory to find out whether the volatility of inventory frequently affects capital investment.

Capital investment plays a self-motivated role in continuing business activities towards its primary goals. It boosts operational activities of firms which enhance new employment opportunities, capital circulations and encourage exports. But ample inventory volatility affects corporate managers through which they are unable to decide how much assets are enough to handle operational activities. Additionally, more inventory volatility leads to liquidity problems which means that the company does not have enough current assets to meet its current expenditure. Therefore, both operations (e.g., inventory managing and fixed assets investment) appear as a backbone in a business which reveals that the company will have to bear opportunity costs by investing more in one operation. Furthermore, it also means that inventory volatility is negatively directed to capital investment. An increase in inventory volatility wrenches investment managers into an ambiguous situation regarding possible demand options and orders (Kim, 2019). The purpose of this study is to find the influence of inventory volatility on capital investment. In addition, unlike inventory volatility, some firm-specific and country-specific factors influence fixed investment. The more profitable firms are more fascinated to invest in those securities whose payback period is short and prefer more profitable rapid investment options. Moreover, the leveraged positively engage with investing in fixed assets because of more additional funds. Similarly, cash inflow is also directly related to capital investment which exhibits that high cash inflow companies invest more in fixed assets because of the additional availability of internal funding resources, which are comparatively more inexpensive than external financing. It further shortened the payback period, which raised investor confidence. Moreover, large firms invest more in fixed assets due to fewer financial constraints. The firms have experts who manage their funds professionally and mitigate their risk. In brief, the firm-specific variables affect capital investment directly and indirectly.

Some macroeconomic factors (e.g., inflation rate, foreign direct investment, interest rate) affect firm capital invest- ment. The inflation rate is a fundamental macroeconomic factor that regulates the numerous economic events in a country. An increment in the inflation rate is more undesirable in developing economies because it declines customer buying power which eventually harms corporate investment due to limited business opportunities. Moreover, an increase in foreign direct investment pursues better economic conditions. Still, it is negatively directed to investment in terms of firms because it enhances ferocious competition for native firms, which disheartens them. Similarly, high-interest rates encourage investors to invest in safe securities, which diminish fixed assets investment. Hence, there is an inverse relationship between interest rate and capital investment (Farooq et al., 2021; Bagh et al., 2021).

The aim of this study is thus to investigate how inventory volatility declines firm-fixed investment decisions. The explanatory variables, i.e., inventory volatility, firm-specific control variables, and country-specific control variables (macroeconomics factors), affect firm capital investment by employing data of two emerging economies (China and Pakistan), which range from 2010–2019. The Driscoll-Kraay test was used with appropriate statistical instruments to deal with shortcoming diagnostics (i.e., cross-section dependence, serial correlation, autocorrelation). The study’s numerical outcomes imply a negative effect of inventory volatility on capital investment. Additionally, the study’s outputs propose a robust investment strategy to corporate managers that high inventory volatility firms should eradicate their inventory volatility behavior and focus more on sustainable inventory growth, giving investors’ confidence to invest in fixed assets. Thus, the current study robustly investigates the dynamic relationship of usual determinants of investment, and it introduces a new determinant in the form of inventory volatility. The significance of the current study is in three folds, i.e., theoretical, empirical, and practical. First, this study contributes to the literature of financial economics as inventory volatility determines capital investment. Moreover, it also has empirical significance, such as inventory volatility was considered a notion before this. Still, the current study has considered inventory volatility as a determinant of investment and checked its empirical relationship between inventory volatility and capital investment. Moreover, the study’s practical significance could assist managers in how they should reflect the sensitivity of inventory volatility in determining capital investment.

The entire discussion, including the objective of this study, is divided into five sections. Section 2 expresses empirical evidence from prior literature on how inventory volatility and other control variables affect capital investment decisions. Moreover, it also discusses the theory and hypothesis development. Similarly, Section 3 reveals the discussion about data description, variable specification, research framework, econometric models, and methodological discussion. It includes a table discussing the variables in detail. Moreover, Section 4 demonstrates the descriptive analysis, correlation details of all variables, and regression models. Finally, Section 5 articulates the conclusion and policy implication of the study.

2. Literature Review

The firm investment decision plays a dynamic role in sustaining firm operational and non-operational activities. Furthermore, the firm capital investment reflects an investment (property, plant, equipment) which also helps to accomplish operational decisions of the firm. It also pronounces that investment adorns business to become an income generator and will be highly appreciated in the future. The decisions regarding investments, specifically in actual business assets, have an enduring effect on corporations’ financial position, steadiness, and business growth, particularly in terms of scarce and limited financial resources. Theory and practice of financial management decisions on capital investments are substantial and fundamental for the future progress of corporations (Bierman & Smidt, 1993; Bock et al., 2018; Khan et al., 2021). The investment decision is not only included to heighten the revenue. Instead, it involves those decisions which help to mitigate expenses. The corporate managers prefer to scrutinize before procurement of fixed assets, investment in financial securities, and asset acquiring, which hoists organization value (Farooq et al., 2021; Roy, 2021). In addition, it also enhances the efficiency of firms that quickly convert their raw materials into finished goods, which also raises cash inflow. Capital investment articulates the longevity of a firm which also helps in debt financing. Moreover, most firms allocate funds according to their experience, which is earned from their past investment. Sometimes over-investment in fixed assets does not lead to profitable decisions for the organization due to ignorance of investment in operational activities.

Furthermore, fixed investment-oriented firms somehow face liquidity problems that nudge them towards inventory management processes. Inventory management can be defined as goods possessed in bulk by a firm for the primary goal of resale. The higher inventory dependence firms may lead to increased risk. They may bear high opportunity cost, which generates impairment losses and high storage cost for the firms but having low inventory dependence firms increase insecurity and cannot accomplish demand, resulting in a low-profit margin and market share (Huang, 2016). The U.S. firms sold off their goods promptly in the March 2001 downturn because uncertainty and a sudden economic slump could result in enormous risks for firms. The most intellectual and efficient firms survived the downfall that enriched and incorporated their inventory management abilities. In this view, technological advances had helped them anticipate changes in demand and avoided drastic changes in production and inventories. A significant consequence of this statement is that better inventory management efficiency may have a minimum business cycle volatility by mitigating the role played by inventory ups and downs (Kahn & McConnell, 2002; Nguyen & Pham, 2021).

Moreover, firms with higher inventory reliance vow to have a better inventory ratio concerning capital and high inventory volatility. The cause behind it is higher levels of average aggregate inventory. Therefore, the new companies tend to have higher volumes and more volatility of inventory. It is advantageous for companies to absorb inventory as much as possible before adjusting fixed capital (Dasgupta et al., 2019). This study by Dasgupta et al. (2019) inspires other companies to hold higher inventories. These additional inventory levels enable firms to produce more at a lower cost; correspondingly, when input prices rise, the firms can be better off by cutting inventory investment and outputs. The inventory volatility is measured as an average coefficient of variation of inventories.

From the literature, an array of studies has empirically examined the effect of different corporate level and macro level variables on firm investment decisions (Farooq et al., 2021). Several researchers have used them as control variables in their studies (Farooq et al., 2021; Wuhan et al., 2015; Pacheco & Miguel, 2017; Mondosha & Majoni, 2018; Hobdari et al., 2009; Hao et al., 2020). These variables are, i.e., profitability, leverage, cash inflow, firm size, inflation, foreign direct investment, and interest rate. The more profitable firms avoid investment in fixed assets because of their short, oriented outcomes on their investment in short term securities. They prefer more profitable and rapid return options (Farooq et al., 2021).

Moreover, the more leveraged firms have a direct relationship with capital investment because of excess funds and high investment opportunities, leading to a positive relationship between leverage and investment. Similarly, high cash inflow directly relates to investment in fixed assets, which reveals a positive relationship between cash inflow and investment. Big size firms always try to invest in capital assets because of less financial constraints and have individual professionals who help them decline failure risk, which shows positive relationships. In addition, country specific variables, i.e., high inflation rate, devalue the currency, leading to increased unemployment and mitigating purchasing power, which peruses an adverse relationship with investment. However, a high-interest rate urges investor to invest in safe investment, i.e., government securities which demote and degrades investment in fixed assets. Thus, we can say that it has an adverse link with capital investment. As moving forward, high foreign direct investment may hoist the host country’s economy, but sometimes it deteriorates the balance of payment, discouraging exporters and local investors through fierce competition (Farooq et al., 2021). Hence, there is an adverse relationship between FDI and investment.

Kim (2019) noted companies uplift their investment choice over two factors of production, i.e., fixed capital investment and inventory volatility which states a robust negative relationship. The reaction of fixed capital investment is overall feebler for companies with more inventory dependence and higher inventory volatility. Furthermore, inventory-dependent companies wane the responsiveness of fixed investment to variation in productivity. Jones and Tuzel (2013) examined the negative relationship between investment in inventory and the cost of capital. Wu et al. (2010) documented adverse relationships between inventory and fixed capital investments. An augmentation of overinvestment in fixed assets increases financial distress due to low investment in inventory, which signals an inverse relationship between inventory investment and fixed assets investment (Kim & Gu, 2006; Kim et al., 2002). Lee and Jang (2013) postulate that if a firm fails to manage its investment in fixed assets, it is more likely to reduce its sales which vindicates an adverse relationship between investment and sales. The paper by Nguyen and Dong (2013) mentioned a significant relationship between investment and changes in net worth.

2.1. Theory and Theorisation

Markowitz (1952) introduced modern portfolio theory in his manuscript entitled “Portfolio Selection.” This theory hoists the self-reliance of investors and enables them to acquire high returns by waning the risk. The risk which is concurrent with individual security is higher than portfolio goods. This theory signifies the impact of an independent variable on a dependent variable by providing theoretical background. The businesses have long-term and short term investments linked with fixed asset investment, labor investment, and financial securities. The optimum investment in one operation is more likely to be riskier. Hence, portfolio managers ignore inappropriate and poor investment behavior, which may cause financial distress and high risk. The Portfolio theory connects inventory volatility with capital investment. The increased inventory dependence firms lead towards high volatility, which may raise financial constraints due to instability. Similarly, an over-investment in fixed assets may impede liquidity problems. There are two activities (i.e., operational and investing) that need to be balanced through modern portfolio theory. Hence, the managers should consider this theory as a helping hand by mitigating the risk of individual investing activities.

The 2nd theory which supports the current study is the “Just in Time” (JIT) theory. This theory deals with the inventory. According to this theory, a corporate firm must have enough inventories to meet current production needs. The firm which holds extra material will pay opportunity and storage costs. This theory emphasizes an inventory regulation system by controlling inventory and delivering an assumption to retain a moderate inventory level. This theory corroborates the quest of the current study objective, which portrays that high inventory volatility will negatively affect capital investment. The Levelized production theory also concentrates on inventory. According to this theory, a firm should maintain a compact raw material inventory to complete consumer demand in time. If a firm has limited raw material or is not accessible at the right time, it will hire additional labor. This can be in the shape of overtime to accelerate production to fulfill customer needs, which pronounces that high inventory volatility will create additional costs for the firm. That cost may be opportunity cost, storage cost, and additional labor cost. The accelerated investment theory demonstrates that a certain sum of capital stock is obligatory to produce a specified output. The internal fund theory of investment determines that the firms invest according to their expected profit. The recognized profit correctly reflects the expected profit. Therefore, the investment is positively connected to realizing a profit.

2.2. Hypothesis Development

The inventory volatility and capital investment augment financial instability, risk, and financial distress. Moreover, both overinvestment and underinvestment operations (e.g., operational activities and investing activities) may cause positive and negative influences. In addition, inventory volatility deteriorates capital investment, exhibiting positive and negative relationships with capital investment. Furthermore, Kim (2019) empirically proved a negative relation of inventory volatility with capital investment, expressing that high inventory acquirer firms are weakly associated with a fixed investment. Lee and Jang (2013) discussed that an inappropriate fixed-assets investment reveals an inverse relationship with sales.

Moreover, three levels of inventory and sale are aligned with each other, which depicts that distortion in raw materials may cause an effect on work in process inventory, finished goods, and finally on sales. Another study by Wu et al. (2010) documented that optimum investment in fixed assets enhances financial distress, which shows an inverse relationship of inventory volatility with capital investment. According to the studies mentioned above, we may hypothesize that:

H1: A significant and negative relationship exists between inventory volatility and capital investment.

3. Material and Methods

3.1. Data Description

This research is based upon secondary data taken from different sources (Thomson Reuters Data Stream). The sample size consists of 1615 non-financial sector firms of China and Pakistan from 2010 to 2019. We have excluded the financial sector firms as the purpose of the research is to analyze the role of inventory volatility in investment which is not permissible in the financial sector. Most financial sector firms imply the services in which inventory does not exist. Furthermore, the financial sector has a different business model than the non-financial sector. Moreover, firms having missed financial information for five or more years were deleted from the sample, resulting in biases. The sample distribution across Pakistan and China is 112 and 1503 relatively. This research follows the deductive approach by considering some macroeconomic variables as control variables to capture the country’s effect on corporate level decisions, i.e., investment decisions. The financial information on macroeconomic variables was retrieved from the World Development Indicators (WDI) specified by The World Bank. A brief description of variables, names, abbreviations, measurements, and references is presented in Table 2.

3.2. Variables Design

In this study, capital investment is considered a dependent variable and measured as fixed assets investment divided by total assets. The previous studies have repeatedly considered this proxy for measuring capital investment (Hamzah, 2017; Farooq et al., 2021). The independent variable is inventory volatility which has been measured as the mean coefficient of variation of inventories. The coefficient of variation is a unit-free measure and is constant across companies of various sizes and over time. The earlier studies also have used this proxy(Birge & Xu, 2011; Steinker & Hoberg, 2013; Bendig, et al., 2018). This research used firm-specific (control) variables, i.e., profitability, measured as EBIT divided by total assets. The leverage ratio is calculated as total debt over total assets. Moreover, the cash inflow rate is measured by net income plus depreciation divided by fixed assets. The size of the firm is logged as total sales. These previously discussed three variables, e.g., profitability, leverage, and firm size, are firm-specific control variables that may determine investment volume. This study has also used macroeconomic variables as country-specific control variables, e.g., inflation rate, calculated as the change in the consumer price index and the interest rate measured as GDP deflator. The FDI (foreign direct investment) is estimated as the net inflow of external investment in a country. Prior studies have used these variables as control variables (Hobdari et al., 2009; Wuhan et al., 2015; Pacheco & Miguel, 2017; Mondosha & Majoni, 2018; Farooq et al., 2021).

3.3. Research Framework

Figure 1 reflects the research framework.

The research framework reveals the relationship between explained and explanatory variables. The right hand side variable is the dependent variable which is capital investment. The left-hand side variables are independent, control variables for firm-specific, and control variables for country-specific, called macroeconomics variables.

Figure 1: Conceptual Framework

3.4. Econometric Model

The general equation for the Fixed Effect model is as follows:

Yit=β0+β1Xjit+β2CVFjit+β3CVCjt+Uit

The above equation exhibits the relationship between explanatory and explained variables. The subscriptions reveal the nature of the sample, i.e., “i” is for firm change, “t” is for time variation and “j” shows the country change. The Yit is represented as the dependent variable. The ..is constant and β0 is coefficient. The CVF stands for control variables firm- specific, and CVC stands for control variables for country- specific. The regression equation below shows the relationship among explained and explanatory variables in Equation 2. The models which are given below were perused to check the regression analysis. The time effect and firm effect are more familiar to unbiased outcomes. Moreover, this tactic advances the competency of regression estimation. The following equations (2 and 3) represent the overall model specification. Furthermore, Equation 3 introduces interaction terms.

INVit=β0+β1ITVit+β2ROAit+β3LVGit+β4CIFit+β5FSit+β6IFRjt+β7FDIjt+β8IRjt+εit

INVit=β0+β1ITVit+β2ITVit*FSit+β3ROAit+β4LVGit+β5CIFit+β6FSit+β7IFRjt+β8FDIjt+β9IRjt+εi

Where, INVit denotes capital investment (investment volume) and INTit represents inventory volatility. The Uit is represented as an error term which is also called residuals.

3.5. Methodology Discussion

The purpose of this study is to analyze the impact of inventory volatility on corporate investment. This research uses panel data which is a mixture of both cross-sectional and time-series data. Dewan and Hussein (2001) disclosed that the panel data could be scrutinized by considering the fixed-effects or random-effects models. These two models are reliable in the absence of correlation amid the independent variables and noise term. Although, if the problem of serial correlation occurs, then the random-effects model is unreliable, and thus, the fixed-effect model should be more reliable and preferred. The fixed-effects model takes deviance from average and eliminates both the influence of time-invariant features and random effects.

Moreover, they also pronounced that it is harmless to scrutinize panel data with a fixed-effects model than applying random effects model due to possible correlation amid independent variables and disturbance terms. Consequently, the decision about fixed effects estimator and random effects estimator should be taken with the help of the Hausman (1978) test. Based on a statistical analysis of the Hausman test, the fixed effect is applicable while estimating the regression among the study variables. Therefore, the random effect model is overlooked, and the fixed effects model is applied first. Furthermore, fixed effect static models may have some issues of serial correlation, cross-section dependence, and autocorrelation. So, to deal with these problems, we used the Driscoll-Kraay Model.

In the coming step, the occurrence of both period fixed effects and cross-section fixed effects are confirmed through the sum of the square of the F-test and likelihood function Chi-square test. Both tests have revealed the existence of cross-section fixed effects and the absence of period fixed effects. Hence, regression models can be projected with only cross-section fixed effects. Therefore, the pooled least squares assessment is not suitable. However, the pooled least squares estimation delivers some understanding of the association between explained and explanatory variables.

Furthermore, we tested the likelihood of correlation amid variables by building a correlation matrix. The occurrence of vigorous correlation among independent variables interrupts one of the fundamental assumptions of Ordinary Least Squares (OLS), which articulates that the explanatory variables should not be correlated with each other. In regression analysis, variables are generally correlated due to their dependency (Table 2). The correlation matrix displays that though there are few correlations, none of them is firm, which could create any significant problem in the results—the regression models projected with cross-section fixed effects.

According to Table 1 (Hausman test), the probability value is less than 0.05, which rejects the null hypothesis and accepts the alternate hypothesis. The literature and empirical findings of the study preferred a cross-section fixed effects model.

4. Results and Discussion

4.1. Descriptive Statistics

The descriptive static results are mentioned in Table 3, which are entitled with the columns, i.e., observations, mean, standard deviation, minimum and maximum.

Table 1: Hausman Test

Table 2: Abbreviations and Variables Detail

Table 3 depicts a brief explanation of the descriptive statistics. The investment (INV) has a mean value of 0.526, revealing that the firm invests 54% in acquiring fixed assets. It has a standard deviation value of 0.205 which reveals the degree of dispersion from its mean value. The average value of inventory volatility (ITV) is –0.158, showing that the 15% negative volatility occurs. In addition, the other statistics, such as the standard deviation is 0.485, display a degree of dispersion from its average value.

Table 3: Descriptive StatisticsFurthermore, the average value of return on assets (ROA) is 0.08, which expresses the company earning capacity by using its assets. Similarly, the leverage (LVG) returned a mean value of 0.298, indicating that average firms use 29.8% debt to finance their assets. This value is low, which demonstrates that average firms rely more on other sources of financing than debt financing. Moreover, the cash inflow (CIF) mean is 0.159, illustrating that most firms get 15.9% cash inflow from operating activities. The log of total sales measures the firm size, and its average value is 2.418. The inflation rate (IFR) is 5.205, which exemplifies the average inflation rate of selected Asian economies. The mean value of FDI is 10.237, which reveals the incoming flow of foreign direct investment in China and Pakistan. The interest rate (IR) has 3.187 its mean value, which exhibits the average interest rate of Pakistan and China. Moreover, other statistics (i.e., median, standard deviation, and range) of control variables for firm-specific and country-specific brief as usual trends and responses in numeric shapes.

4.2. Correlation Detail

Table 4 depicts the overview of the correlation analysis among variables included in this study. The inventory volatility (ITV) has a negative value of –0.053, which shows that inventory volatility negatively

Table 4: Correlation Matrix

correlates with determining capital investment (INV). It means that firms show low interest in fixed assets investment due to high inventory volatility. Furthermore, the profitability (ROA), cash inflow rate (CIF), and firm size (FS) have negative values of –0.105, –0.409, and –0.130, expressing that profitability, cash flow rate, and firm size negatively determine capital investment. On the other hand, the leverage (LVG), inflation rate (IFR), interest rate (IR) has positive values as 0.203, 0.079, and 0.059, respectively, stating that the relationship of investment with these variables moves on the same path. But one macroeconomic variable, i.e., foreign direct investment (FDI), has a value of –0.122, which is negatively correlated with investment in fixed assets. Column 3 presents a correlation summary among inventory volatility (ITV) and the rest of the study variables. The ROA, LVG, CIF, IFR, and IR positively correlate with inventory volatility, whereas FS and FDI are negatively correlated.

Column 4 represents the summary of ROA with other variables of this study. The LVG, FDI, and IR are negatively correlated, while CIF, FS, and IFR positively correlate with inventory volatility. Column 5 briefs the correlation of leverage among other variables of the study. The FS, IFR, and IR correlate positively with leverage, and CIF and FDI correlate negatively with leverage. Column 6 of Table 4 exhibits the correlation summary of CIF. The FS and IFR positively correlate with CIF, whereas FDI and IR have a negative correlation. In column 7, the IFR and IR are negatively correlated, while FDI is positively correlated with FS. The FDI and IR are negatively correlated with IFR in column 8, whereas in column 9, the IR is negatively correlated with FDI.

4.3. Regression Analysis

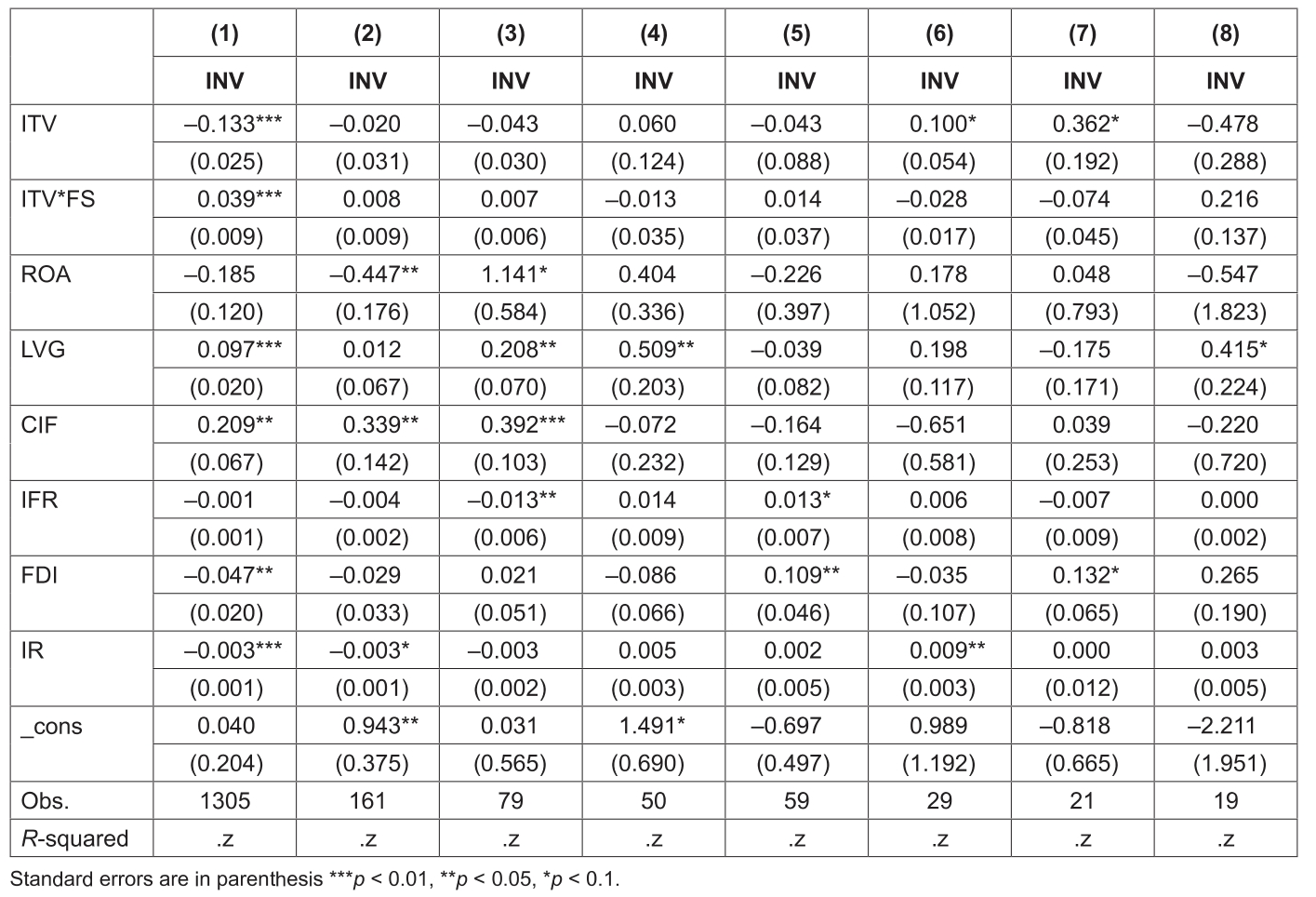

The outputs of the regression model have revealed in Table 5.

Table 5: How Inventory Volatility Changes Capital Investment (Regression Results Fixed) (Effect Model)

In Table 5, capital investment was considered a dependent variable, and a fixed-effect model was used due to the existence of correlation among independent variables and noise terms. Implementing the Hausman test verifies the suitability of a fixed-effect model through its p-value, which is less than 0.05 values. The inventory volatility (ITV) has a negative and significant coefficient value, which portrays that high inventory volatility inevitably makes investment managers ambi- guous. It also means that an increment in inventory volatility leads to decreased investment in fixed assets (Kim, 2019). More specifically, an augmentation of inventory volatility lands investment managers in an ambiguous state regarding the investment decision. The firm-specific control variables, i.e., profitability (ROA), have exhibited a negative and significant impact on capital investment because they do not prefer to curb their retained earnings in long-term investment. They are more focused on investing in profitable short-term securities and quick corporate investment options (Mondosha & Majoni 2018; Farooq et al., 2021). The leverage (LVG) has unveiled a positive and significant coefficient value which states that highly leveraged firms invest more in fixed assets due to excessive funds (Farooq et al., 2021). The cash flow rate (CIF) has a positive and significant coefficient value which describes that high cash inflow companies prefer to invest more in fixed assets because of extra availability of internal incomes that are comparatively low cost than outdoor financing. It further reduced the payback period, which raised investor confidence for investing more. The firm size has a positive and significant coefficient value which articulates that when size enhances, the capital investment also increases. Further, large firms face minimum financial constraints, and they have financial specialists handling funds efficiently and minimizing the risk (Farooq et al., 2021).

Moreover, country-specific, i.e., inflation rate (IFR), foreign direct investment (FDI), and interest rate (IR), have a negative and significant coefficient value. An upsurge inflation rate demonstrates a reduction in the value of the currency. An augmentation in the inflation rate is more unsuitable in emerging economies because it mitigates customer buying power and, lastly, disturbs corporate investment due to limited business opportunities. Moreover, the high-interest rate inspires investors to invest in low-risk securities, which reduces fixed assets investment. Hence, there is an inverse relationship between interest rate and corporate investment (Li & Khurshid, 2015). Likewise, an escalation in FDI leads to improving the economic situation. Still, it is inversely directed to firms’ corporate investment because it boosts competition for indigenous firms, which discourages them (Farooq et al., 2021).

Table 6 considered cross-section dependence, serial correlation, and autocorrelation by using the Driscoll-Kraay model. Again, consistent results were obtained (shown in Table 5) under the fixed effect model.

In Table 7, we introduced the interaction term using the fixed-effect model and Driscoll-Kraay model. The negative impact of inventory volatility can be changed by increasing sales volume, leading to investing more in fixed assets. It also increases the significance level of inventory volatility with capital investment. The rest of the variables have the same results as in Table 4 and Table 5.

Table 6: Robustness with Alternative Estimator: Driscoll-Kraay Standard Errors

Table 7: How Inventory Volatility Works with Firm Size as an Interaction Term Regression Results

We have examined the robustness across industries by using the Driscoll-Kraay model (Table 8). Consistent results were obtained as mentioned in previous tables.

Table 8: Robustness: Across Industries (Driscoll-Kraay Results)

In Table 9, the robustness across industries by introducing interaction terms in the shape of firm sale volume. Again, the same consistent results were found.

Table 9: Regression Results 5. Conclusion

5. Conclusion

This research is envisioned to deliver a better understanding of how inventory volatility affects firm capital investment. To achieve the objective, we collected data from non-financial firms of two emerging economies ranging from 2010–2019. The Driscoll-Kraay model was employed to resolve the problem of autocorrelation, serial correlation, and cross-section dependence. The findings of the study demonstrated that inventory volatility affects corporate capital investment significantly and negatively. Furthermore, the findings reveal that when inventory volatility increases, then the capital investment will decrease. In addition, inventory volatility deteriorates the primitive and compact investment designing of managers regarding fixed assets. Moreover, the statistical analysis also confirms the dynamic impact of control variables on corporate capital investment.

In this technological era, all businesses are more concerned about their future goals through considering fixed assets investment. The empirical outcomes of this study clarify that how inventory volatility influences capital investment. Corporate managers should ponder about inventory volatility which impacts capital investment and cannot be avoided. The managers should approach that helps them manage investment in fixed assets by handling uncertain variability in inventory. Furthermore, policies should motivate managers to invest in fixed assets properly by analyzing unseen inventory fluctuation. More specifically, the intensive inventory firms should focus on managing inventory and reducing volatility as it hampers the capital investment volume of corporate firms. The other emerging economies which have the same business setting can also use these findings. The empirical implementation of these findings is that the previous studies have used the tradeoff between inventory and capital investment. But the current research mitigates the difference by considering inventory volatility.

References

- Bagh, T., Khan, M.A., Meyer, N., Sadiq, R. & Kot, S. (2021). Determinants of Corporate Cash Holdings Among Asia's Emerging and Frontier Markets: Empirical Evidence from Non-Financial Sector. The Journal of Asian Finance, Economics and Business, 8(6), 661-670. https://doi.org/10.13106/jafeb.2021.vol8.no6.0661

- Bierman, H. & Smidt, S. (1993). The capital budgeting decision: Economic analysis of investment. New York: Routledge Taylor and Francis Group.

- Birge, J. R. & Xu, X. (2011). Firm Profitability, Inventory Volatility, and Capital Structure. SSRN Electronic Journal, 23, 1-37. https://doi.org/10.2139/ssrn.1914690

- Bock, C., Huber, A., Thies, F., Kraus, S. & Alexander, B. (2018). July. The relevance of crowdfunding campaigns for venture capitalists' syndication behavior. In: Academy of Management Proceedings (Vol. 2018, No. 1, p. 11980). Briarcliff Manor, NY 10510: Academy of Management. https://doi.org/10.5465/AMBPP.2018.11980abstract

- Carpenter, R. E., & Guariglia, A. (2008). Cash flow, investment, and investment opportunities: New tests using U.K. panel data. Journal of Banking & Finance, 32(9), 1894-1906. https://doi.org/10.1016/j.jbankfin.2007.12.014

- Dasgupta, S., Li, E. X. & Yan, D. (2019). Inventory behavior and financial constraints: Theory and evidence. The Review of Financial Studies, 32(3), 1188-1233. https://doi.org/10.1093/rfs/hhy064

- Dewan, E., & Hussein, S. (2001). Determinants of economic growth (Panel data approach). Suva: Economics Department, Reserve Bank of Fiji.

- Farooq, U., Ahmed, J. & Khan, S. (2020). Do the macroeconomic factors influence the firm's investment decisions? A generalised method of moments (GMM) approach. International Journal of Finance and Economics, 1-12. https://doi.org/10.1002/ijfe.1820

- Hamzah, S. O. (2017). Determinants of Cooperate investment decision: Evidence from quoted manufacturing firms in Nigeria. International Journal of Commerce and Management Research, 77-81.

- Hao, J., Li, C., Yuan, R., Ahmed, M., Khan, M. A., & Olah, J. (2020). The Influence of the Knowledge-Based Network Structure Hole on Enterprise Innovation Performance: The Threshold Effect of R&D Investment Intensity. Sustainability, 12(15), 6155, 1-17. https://doi.org/10.3390/su12156155

- Hobdari, B., Jones, D. C. & Mygind, N. (2009). Capital investment and determinants of financial constraints in Estonia. Economic Systems, 33(4), 344-359. https://doi.org/10.1016/j.ecosys.2009.05.004

- Huang, J. (2016). A Review of Inventory Investment: The Macro and Micro Perspective. Journal of Financial Risk Management, 05(01), 57. https://doi.org/10.4236/jfrm.2016.51007

- Jones, C. S. & Tuzel, S. (2013). Inventory investment and the cost of capital. Journal of Financial Economics, 107(3), 557-579. https://doi.org/10.1016/j.jfineco.2012.09.001

- Kahn, J. A. & McConnell, M. M. (2002). Has inventory volatility returned? A look at the current cycle. Current issues in economics and finance, 8(5).

- Khan, H., Khan, M. A., Ahmed, M., Popp, J., & Olah, J. (2021). The Nexus between Export Diversification and Foreign Direct Investment: Empirical Evidence from China. Montenegrin Journal of Economics, 17(2), 121-134. https://doi.org/10.14254/1800-5845/2021.17-2.9

- Kim, H. & Gu, Z. (2006). Predicting restaurant bankruptcy: A logit model in a comparison with discriminant model. Journal of Hospitality & Tourism Research, 30(4), 474-493. https://doi.org/10.1177/1096348006290114

- Kim, H., Gu, Z. & Mattila, A. S. (2002). Hotel real estate investment trusts' risk features and beta determinants. Journal of Hospitality & Tourism Research, 26(2), 138-154. https://doi.org/10.1177/1096348002026002004

- Kim, K. (2019). Inventory, fixed capital, and the cross-section of corporate investment. Journal of Corporate Finance, 60. https://doi.org/10.1016/j.jcorpfin.2019.101528

- Lee, S. K. & Jang. S. (2013). A portfolio approach in lodging firms' investment behavior: Examining investment-disinvestment interdependency. Cornell Hospitality Quarterly, 54(3), 318-326. https://doi.org/10.1177/1938965513482518

- Li, S. & Khurshid, A. (2015). The effect of interest rate on investment; empirical evidence of Jiangsu Province, China. Journal of International Studies, 8(1), 81-90. https://doi.org/10.14254/2071-8330.2015/8-1/7

- Markowitz, H. (1952). Portfolio Selection. The Journal of Finance, 7(1), 77-91. https://doi.org/10.1111/j.1540-6261.1952.tb01525.x

- Mondosha, M., & Majoni, A. (2018). The impact of leverage on investment decisions for South African firms with different growth opportunities. Journal of Economic and Financial Sciences, 11(1), 1-7. https://doi.org/10.4102/jef.v11i1.192

- Nguyen, P. D. & Dong, P. T. A. (2013). Determinants of Corporate Investment Decisions: The Case of Vietnam. Journal of Economics and Development, 15(1), 32-48. https://doi.org/10.33301/2013.15.01.02

- Nguyen, P. T. & Pham, T. T. T. (2021). The impact of financial development on economic growth: Empirical evidence from transitional economies. The Journal of Asian Finance, Economics and Business, 8(11), 191-201. https://doi.org/10.13106/jafeb.2021.vol8.no11.0191

- Subhani, B. H., Farooq, U., Bhatti, M. I., & Khan, M. A. (2021). Economic Policy Uncertainty, National Culture, and Corporate Debt Financing. Sustainability, 13(20), 11179. https://doi.org/10.3390/su132011179

- Roy, S. (2021). Absorptive capacity effects of foreign direct investment in selected Asian economies. The Journal of Asian Finance, Economics and Business, 8(11), 31-39. https://doi.org/10.13106/jafeb.2021.vol8.no11.0031

- Wu, J., Zhang, L. & Zhang, X. Z. (2010). The q-theory approach to understanding the accrual anomaly. Journal of Accounting Research, 48(1), 177-223. https://doi.org/10.1111/j.1475-679X.2009.00353.x